You might be able to flip equipment you possess into money in your business using a sale-and-leaseback. There you primarily offer the equipment to some financing firm for income and lease the equipment back from them. At the conclusion of the term, you could return the equipment or invest in it through the lender.

Get yourself a business loan and make an offer. Unless there is a good deal of cash readily available, you'll need a business loan to finance the acquisition of the laundromat. Look into our leading picks of lenders for the laundromat business loan.

Mortgage loan calculatorDown payment calculatorHow Significantly dwelling can I afford calculatorClosing expenditures calculatorCost of residing calculatorMortgage amortization calculatorRefinance calculatorRent vs acquire calculator

You may use equipment loans to purchase property including office and computer equipment, industrial machinery and business cars.

Repayment terms and desire premiums on equipment loans may vary depending upon the equipment finance corporation, your business’s skills and how long the equipment you’re getting is projected to have price.

Overview: First Citizens Financial institution presents customizable equipment financing which might be structured to fulfill your particular person tax or accounting requires.

Evaluations Disclosure: The responses beneath aren't supplied or commissioned from the bank card, financing and service providers that appear on This page.

Any time you borrow dollars, you must be sure to have an close purpose along with a reason in mind. That’s true no matter if you need to borrow money to acquire equipment, broaden your business, as well as only for having a small amount of enable with operating fees.

So how do we make money? how to get a 20k business loan Our partners compensate us. This might influence which products and solutions we review and write about (and where by those products appear on the internet site), nonetheless it in no way influences our suggestions or assistance, which are grounded in A large number of several hours of exploration.

Determine what the business is truly worth. Use various valuation techniques to get a standard concept of the fair market worth of the business you happen to be looking to invest in to ensure that you're obtaining a good deal.

Self-collateralizing: Because the equipment is frequently utilised as collateral with the loan, there may be less reliance on personal credit score, time in business or other collateral.

The SBA commonly won't grant loans to businesses which are regarded "passive money" functions, which includes businesses like rental real estate.

We update our facts routinely, but data can change between updates. Ensure facts with the service provider you might be considering before making a call.

Some small-business lenders may finance several of the soft fees including supply, installation, warranties, assembly together with other a single-time charges required to Obtain your equipment arrange and working.

Neve Campbell Then & Now!

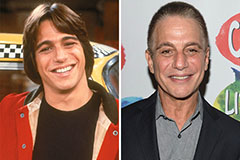

Neve Campbell Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Samantha Fox Then & Now!

Samantha Fox Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!